The Senate must investigate the utter failure of the Bureau of Internal Revenue (BIR) to collect the P203-billion estate tax liabilities owed by the descendants of former President Ferdinand Marcos to the government, vice-presidential aspirant Senator Kiko Pangilinan said.

“Nakapanlulumong isipin na P203 bilyong ng estate tax liabilities ng mga Marcoses ang ilang taon ng hindi nakokolekta ng BIR. Sa gobyernong tapat, marami ang matutulungan nang ganyang kalaking halaga. Malayo ang mararating ng P203 bilyon kung maayos na gagamitin at walang tongpats,” Pangilinan said.

“Napakalaking dagok nitong pagkukulang na ito ng BIR sa ordinaryong taxpayer na Pilipino.”

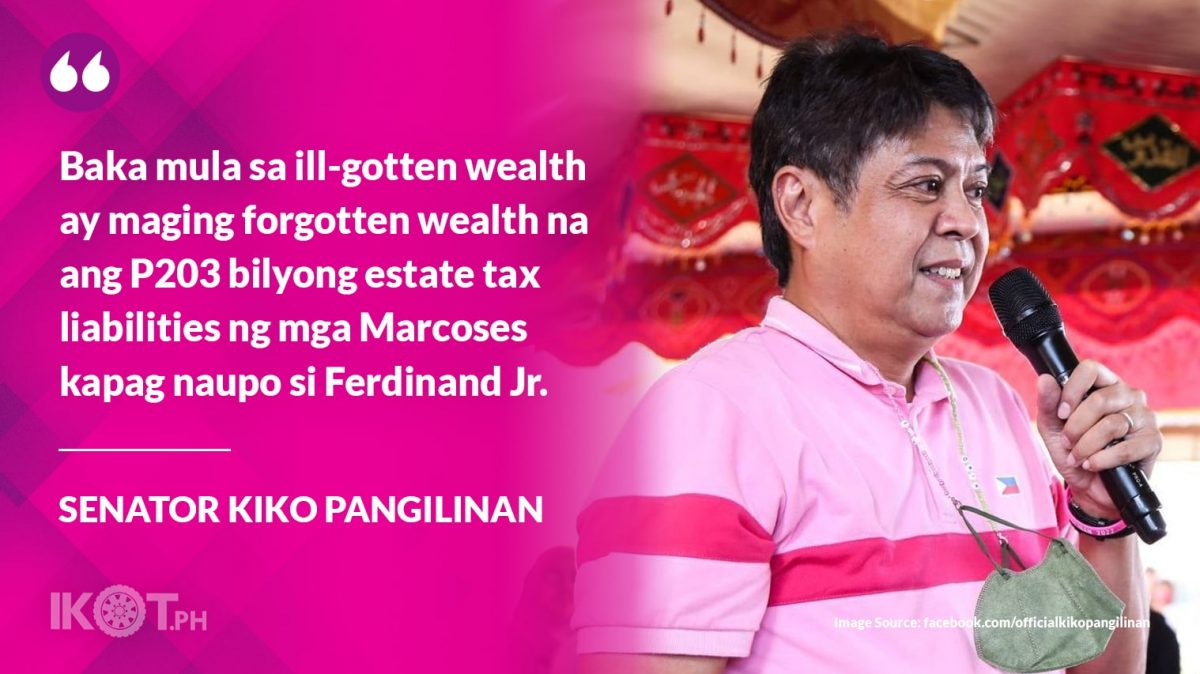

“Baka mula sa ill-gotten wealth ay maging forgotten wealth na ang P203 bilyong estate tax liabilities ng mga Marcoses kapag naupo si Ferdinand Jr. Napakalaking dagok nitong pagkukulang na ito ng BIR sa ordinaryong taxpayer na Pilipino. Ang ordinaryong Pilipino taxpayer, bago makuha ang kakarampot na sweldo, ay nakaltas na ang sanlaksang taxes,” the seasoned legislator said.

“Kung maalala ninyo ay nagplano ang BIR na kumulekta ng taxes sa mga local small online sellers who were trying to keep their businesses alive and to pay their employees, pero mayroon palang uncollected na P203 bilyon mula sa mga Marcoses,” the veteran lawmaker said.

“Dapat panagutin ang BIR leadership at lahat ng kasangkot sa kapabayaang ito.”

“Dapat panagutin ang BIR leadership at lahat ng kasangkot sa kapabayaang ito,” the senator said.

Senator Koko Pimentel III said he was seeking commitment from his colleagues to start a Senate investigation in aid of legislation on the uncollected Marcos estate taxes.

Pimentel had earlier filed Senate Resolution 998, seeking to direct the concerned Senate committee to investigate the BIR failure to collect the taxes due on the Marcos estate since 1997.

Earlier, retired Supreme Court Senior Associate Justice Antonio Carpio rejected statements that the Marcos descendants were not under any legal obligation to settle their unpaid estate tax.

Carpio said Section 91 of the NIRC categorically states that the estate tax “shall be paid by the executor or administrator before delivery to any beneficiary of his distributive share of the estate”.

Similarly, he said this was also mentioned in BIR Revenue Regulations Nos. 12-2018 and 17-1993, which added that “where there are two or more executors or administrators, all of them are severally liable for the payment of the tax”.

Carpio said the Supreme Court declared in its March 9, 1999, ruling on the Marcos estate tax case, filed as GR No. 120880, was already “final and executory”.

The Philippine Daily Inquirer estimated that P203 billion can:

- build 406,000 housing units for the poor at P500,000 per unit;

- pay for 8 years the P56,000 monthly salary of the needed 398 doctors to the barrios;

- provide P9,900 assistance to each of the 20.5 million poor Filipino families;

- provide P270,000 to each of the 70,000 victim-claimants of the Marcos dictatorship;

- enough to feed children aged 5 to 11 for five years;

- enough to provide P750 minimum daily wage for one year to 902,000 workers;

- enough to pay nine times over the P21.1 billion debt of PhilHealth;

- enough to provide P120,000 scholarships to 422,000 students in higher educational institutes for four years;

- enough to provide P80,000 scholarships to 634,375 students in state colleges and universities for four years;

- at P2.3 billion per building, enough to construct 88 ten-story modern hospitals;

- at P80.2 million per building, enough to construct 2,500 eight-story buildings;

- using the proposed entry level rate of P30,000, enough to pay entry-level teachers.